Freight & Trucking Outlook: Summer into Q3/Q4

With the drumbeat of recession chatter, combined with falling year-over-year shipment volume and pricing, it can be easy to be pessimistic. However, it’s important to be cautious with year-over-year numbers: artificially high demand for durable goods through most of the pandemic—caused by an artificially low supply of consumer services due to quarantines—helped produce artificially high shipping costs. Thus, comparing metrics to 2019 can be more relevant so 2023 demand levels look better and are looking a lot like 2019.

Beware Artificially Low Contract Pricing & Paper Rates

One difference in 2023 is that spot pricing is down quite a bit. There are many instances where spot pricing is lower than contract pricing. This is helped by the increased transportation demand for durable goods in the pandemic attracting additional carriers to the market. Some carriers are close to shutting their doors, so they may offer lower, near-term contract pricing to help maintain cash flow. It’s imperative that LiVe and Omni Logistics resist the temptation to match artificially low pricing.

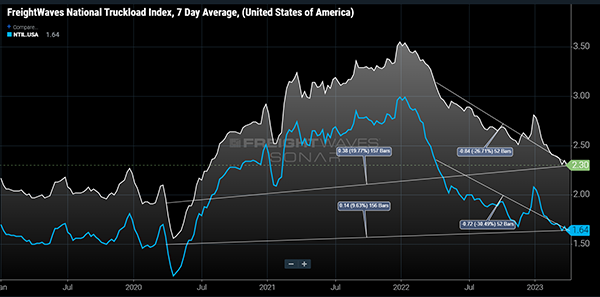

From the FreightWaves April 2023 report: “Spot rates for dry van freight as measured by the National Truckload Index (NTI) fell throughout the month, having dropped nearly 27% y/y by the start of April. Spot rates excluding total estimated fuel costs (NTIL) are down 30% versus last year, but only up 9% over early April of 2020. Considering the cost of operations has increased more than 9% for many over the past three years, the spot market is mostly filled with below cost freight. The fact that spot rates are still falling will accelerate the occurrence of exits, supporting increased rate volatility later in the year.”

Spot Rates Pre- and Post-Pandemic (FreightWaves)

Less Tolerance for Transportation Mistakes

Through the pandemic, the C-suite become more tolerant of increased transportation costs. As the pandemic wanes, so does their tolerance, so it’s never been more important to keep the freight total cost of ownership (TCO) low for our clients and to back them up with reporting when they are called before their leadership team to explain what’s going on with supply chain costs.

Manufacturing Is Down

Manufacturing is in a contractionary phase when taking the Institute for Supply Managements’ Purchasing Managers’ Index (PMI) into account. The overall index dropped to 46.3 percentage points with new orders down to 44.3 and backlogs at 43.9. The lack of new orders and dwindling backlogs suggest that the sluggish upstream activity will make its way into the second quarter. Industrial production rose by 0.5% in March, but much of the rise came from utilities, up 8.4% for the month, while the manufacturing component dropped 0.5% over the same period. The general slower trend in manufacturing and stagnant business-to-business activity will likely persist into the early parts of the third quarter.

North America Freight Outlook Summary

- The market may remain mostly unchanged through the end of 2023

- Many Q1 earnings calls indicated little sign of recovery is on the horizon

- Spot prices may increase Q3/Q4 as volume increases and capacity decreases

- Knight-Swift, Old Dominion and others remain uncertain as to when demand will improve

North America Freight Outlook Summary

- The market may remain mostly unchanged through the end of 2023

- Many Q1 earnings calls indicated little sign of recovery is on the horizon

- Spot prices may increase Q3/Q4 as volume increases and capacity decreases

- Several carriers remain uncertain as to when demand will improve

What Transportation & Logistics Professionals Should Know

Recent Market Headlines

- Trucking execs share weak Q2 outlook

- XPO expects $50M in savings from headcount cuts

- FedEx Freight to close 29 locations and furlough more workers

Expectation of Spot vs. Contract Pricing

- We’re likely approaching the bottom of the spot market correction but there is uncertainty on how long the bottom will last

- There are more trucks in the market than demand

- Spot rates fell an additional 3% in March

- Food and beverage consumption is up during summer months, so expect refrigerated rates to rise before dry van

- Construction is up during the summer months, so expect flatbed rates to increase before dry van rates